- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C04 INTRODUCTION TO DERIVATIVES

Reading Time: 2 min read

OTC MARKET #

OTC Market is customized trading market which utilizes telephone & computers to make trade. Advantage:- Terms are not specified, hence participants have more flexibility to negotiate. Disadvantage:- The credit risk is higher.

OPTION CONTRACT #

Option contract gives the option buyer the right to buy (sell) an asset at the exercise price from (to) the option seller.

Call option: Gives the option holder the right to buy the underlying asset at a specified price.

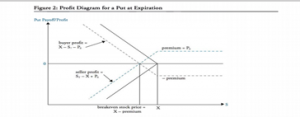

Put option: Gives the option holder the right to sell the underlying asset at a specified price.

Payoff & profit of call option & put option

Where X = Exercise price/ Strike price of option,

| CALL | PUT | |

| BUYER: Payoff

Profit |

MAX(0, ST-X)

MAX (0,ST-X)-C |

MAX(0,X-ST)

MAX(0,X-ST)-P |

| SELLER: Payoff

Profit |

-MAX(0,ST-X)

C-MAX(0,ST-X) |

-MAX(0,X-ST)

P-MAX(0,X-ST) |

ST= Stock price at Maturity,

C= Call premium

P= Put premium

FORWARD CONTRACT #

It is a contract between two parties to buy or to sell an asset at a specified future time at a price agreed today.

Payoff of long position = St – K

Payoff of short position = K – St

Where K = delivery price

FUTURES CONTRACT #

It is a more formalized, legally binding agreement to buy/sell a commodity/ financial instrument at a price agreed today but delivered and paid on a later date.

HEDGING STRATEGIES #

Hedgers use forward contracts & options to reduce or eliminate financial exposure by entering into an offsetting position.

SPECULATIVE STRATEGIES #

Speculators use derivatives to make bets on the market. Risk is higher than average, in return for a higher– than– average profit potential. Speculation requires limited amount of initial investment creating significant leverage.

ARBITRAGE OPPORTUNITIES #

Arbitrageurs earn a risk-free profit through the discovery and manipulation of mis-priced securities by entering into equivalent offsetting positions. Arbitrage opportunities does not last long as supply & demand forces eliminates the pricing differences.

SOME OTHER IMPORTANT DERIVATIVE TERMS #

MARKET MAKER: A dealer in securities or other assets who undertakes to buy or sell at specified prices at all time.

SPOT CONTRACT: An agreement to buy/sell an asset today.

AMERICAN OPTIONS: Contract can be exercised any time between issue date & expiration date.

EUROPEAN OPTIONS: Contract can be exercised only at the time of expiration.

Updated on August 31, 2022