- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C20 FOREIGN EXCHANGE RISK

Reading Time: 1 min read

BASICS OF FOREIGN EXCHANGE #

DIRECT QUOTE:- Home currency denoted as one unit of foreign currency Eg. $1= ₹ 65

INDIRECT QUOTE:- Foreign currency as one unit of home currency Eg. ₹1= $ 0.0154

BID ASK RATES #

![]()

![]()

![]()

Exam note:- If transaction is in between interbank market to BANK then interbank market will quote. (Similar to question in question bank)

Net exposure (IMP) (FRM PART I May 17 EXAM) #

Net position exposure (Say USD) = (USD Asset – USD Liability) + (USD Bought – USD Sold )

IF ANSWER IS + THEN BANK IS NET LONG AND ( – ) THEN NET SHORT

(Note: Refer question bank and its alternate possible variation to be asked in exam in Q No 13 in Question bank Pro)

FOREIGN EXCHANGE TRADING ACTIVITY #

4 KEY TRADING ACTIVITY

- INTERNATIONAL COMMERCIAL BUSINESS TRANSACTION SALE/ BUY OF GOODS ETC

- TAKE POSITION IN REAL FOREX INVESTMENT

- OFSETTING EXPOSURE – HEDGING

- SPECULATING OF FOREIGN CURRENCIES.

PARITIES (PURCHASING POWER PARITY) VIMP (MAY 16) #

States exchange price should be reflective of purchasing power in both the countries.

Forward rate calculation using purchasing power parity.

F= FWD rate IH = inflation in home currency

S= SPOT rate IF = Inflation of foreign currency

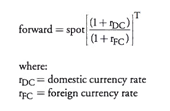

PARITIES (Interest Rate) VIMP #

Forward rate calculation using interest rate parity.

Note:- Solve all the questions from the question bank given on these two concepts

If interest rate is in continuously compounded.

![]()

RELATION BETWEEN (Int. Rate and inflation) #

(1 + Nominal rate) = (1+ Real Rate )(1 + inflation rate)

Updated on August 31, 2022