- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C13 PROPERTIES OF STOCK OPTIONS

Reading Time: < 1 min read

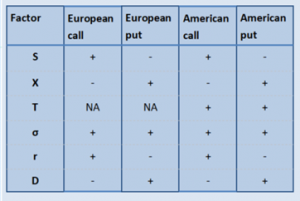

FACTORS EFFECTING OPTION PRICES #

Effect of increasing a factor on the price of an option:

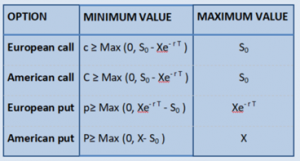

LOWER & UPPER BOUNDS FOR OPTIONS #

Where, c = value of European call option

C = value of American call option

p = value of European put option

P = value of American put option

PUT CALL PARITY #

Put call parity is the relationship that must exists between the prices of European put & call option, having same underlie, strike price and expiration date.

Call + Xe – rT = S0 + Put

| |

Fiduciary call Protective put

RELATIONSHIP BETWEEN AMERICAN CALL & PUT OPTION #

Put call parity only holds for European option. For American options, we have an inequality.

S0 – X ≤ C – P ≤ S0 – Xe – r T

IMPACT OF DIVIDENDS ON OPTION PRICING BOUNDS #

To prevent arbitrage, when a stock pays a dividend, its value must decrease by the amount of the dividend. This increases the value put & decreases the value of call.

European option:

c ≥ S0 – D – Xe – r T

p ≥ S0 – D – Xe – r T

Early exercise of American option:

P + S0 = C + D + Xe – r T

S0 – X –D ≤ C – P ≤ S0 – Xe – r T

Updated on August 31, 2022