- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C14 THE BLACK-SCHOLES-MERTON MODEL

Reading Time: 3 min read

LOGNORMAL STOCK PRICES

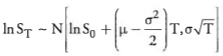

The model used to develop the Black-Scholes-Merton (BSM) model assumes stock prices are lognormally distributed:

Where:

ST =stock price at time T

S0 = stock price at time 0

µ = expected return on stock per year

σ = volatility of the stock price per year

N [m,s]=normal distribution with mean=m and standard deviation = s.

EXPECTED VALUE #

Using the properties of a lognormal distribution, we can show that the expected value of ST, E(ST), is:

![]()

Where: µ = expected rate of return

HISTORICAL VOLATILITY & IMPLIED VOLATILITY #

The volatility estimation process is a matter of collecting daily price data and then computing the standard deviation of the series of corresponding continuously compounded returns. Continuously compounded returns can be calculated as:

ln(Si / Si-1). The annualized volatility is simply the estimated volatility multiplied by the square root of the number of trading days in a year.

Historical data can serve as a basis for what volatility might be going forward, but it is not always representative of the current market. Consequently, practitioners will use the BSM option pricing model along with market prices for options and solve for volatility. The result is what is known as implied volatility.

Implied volatility is the value for standard deviation of continuously compounded rates of return that is “implied” by the market price of the option.

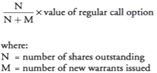

VALUATION OF WARRANTS #

Warrants are attachments to a bond issue that give the holder the right to purchase shares of a security at a stated price. Assuming there is no benefit to the company from issuing warrants, the value of each warrant is computed as:

BLACK-SCHOLES–MERTON MODEL ASSUMPTIONS #

The assumptions underlying the BSM model are the following:

- The price of the underlying asset follows a lognormal distribution.

- The (continuous) risk-free rate is constant and known.

- The volatility of the underlying asset is constant and known.

- Markets are “frictionless.”

- The underlying asset has no cash flow, such as dividends or coupon payments.

- The options valued are European options, which can only be exercised at maturity. The model does not correctly price American options.

- No arbitrage.

BLACK-SCHOLES-MERTON OPTION PRICING MODEL #

The formula for the BSM model are:

Cash flows on the underlying asset decrease call prices and increase put prices.

BSM MODEL WITH DIVIDENDS #

EUROPEAN OPTIONS

Subtract the present value of expected cashflows from the asset price in the BSM model. Since the BSM model is in continuous time, in practice S0 x e -qT is substituted for S0 in the BSM formula, where q is equal to the continuously compounded rate of dividend payment.

AMERICAN OPTIONS

Dividends complicate the early exercise decision for American-style options because a dividend payment effectively decreases the price of the stock.

If the call option is unexercised and the dividend is paid, its unexercised value is:

![]()

For American put options, early exercise becomes less likely with larger dividends. The value of the put option increases as the dividend is paid. Early exercise is, therefore, not optimal as long as

![]()

Updated on February 16, 2022