- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

FRM / CFA Part I R 10 BOND YIELD AND RETURN CALCULATION

Reading Time: 4 min read

REALIZED RETURN #

The gross realized return for a bond is its end-of-period total value minus its beginning- of-period value divided by its beginning-of-period value. The end-of-period total value will include both ending bond price & any coupons paid during the period.

The net realized return for a bond is its gross realized return minus per period financing costs. Cost of financing would arise from borrowing cash to purchase the bond.

When a bondholder receives coupon payments, the investor runs the risk that these cash flows will be reinvested at a rate that is lower than the expected rate. This is known as reinvestment risk.

BOND SPREAD #

The market price of a bond may differ from the computed price of a bond using spot rates or forward rates. Any difference between bond market price and bond price according to the term structure of interest rates is known as the spread of a bond. A bond’s spread is a relative measure of value which helps investors identify whether investments are trading cheap or rich relative to the yield curve (i.e., the term structure of rates).

YIELD TO MATURITY #

The yield to maturity, or YTM, of a fixed-income security is equivalent to its internal rate of return. The YTM is the discount rate that equates the present value of all cash flows associated with the instrument to its price.

For a security that pays a series of known annual cash flows, the computation of yield uses the following relationship:

CARRY-ROLL-DOWN SCENARIOS #

- The realized forward scenario assumes that forward rates are equal to expected future spot rates, and over the investment horizon, these forward rates will be realized.

- The unchanged term structure scenario simply assumes that the term structure will remain unchanged over the investment horizon. This means that the gross realized return will depend greatly on the relationship between the bond’s coupon rate and the last forward rate before the bond matures. This scenario implies that there is a risk premium built into forward rates.

PRICE OF AN ANNUITY & PERPETUITY #

CALCULATING THE PRICE OF AN ANNUITY

An annuity is a series of periodic payments that are received at a future date.

PV of Annuity = P [ 1-(1+r)-n ]/r

CALCULATING THE PRICE OF PERPETUITY

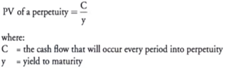

The perpetuity formula is straightforward and does not require an iterative process:

SPOT RATES, YTM, COUPON RATES & PRICE #

RELATIONSHIP BETWEEN SPOT RATES & YTM

When pricing a bond, YTM or spot rates can be used. The YTM will be a blend of the spot rates for the bond.

RELATIONSHIP BETWEEN YTM, COUPON RATE & PRICE

- If coupon rate > YTM, the bond will sell for more than par value, or at a

- If coupon rate < YTM, the bond will sell for less than par value, or at a

- If coupon rate = YTM, the bond will sell for par value.

COUPON EFFECT

If two bonds are identical in all respects except their coupon, the bond with the smaller coupon will be more sensitive to interest rate changes. All else being equal:

- The lower the coupon rate, the greater the interest-rate risk.

- The higher the coupon rate, the lower the interest-rate risk.

Bonds with similar maturities, but different coupon rates, can have different yield to maturities.

CARRY-ROLL-DOWN SCENARIOS #

Return decomposition for a bond breaks down bond P&L into component parts. This decomposition of P&L helps bond investors understand how their investments are making or losing money. A bond’s profitability or loss is generated through price appreciation and explicit cash flows. Bond total price appreciation can be broken down into three component parts for price effect analysis: carry-roll-down, rate changes, and spread change.

- The carry-roll-down component accounts for price changes due to interest rate movements from the original term structure to an expected term structure, R’, as the bond matures.

- The rate changes component accounts for price changes due to interest rate movements from an expected term structure to the original term structure that exists at time t.

- The spread change component accounts for price changes due to changes in the bond’s spread from t— 1 to t.

Updated on June 11, 2023