- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C14 TRADING STRATEGIES

Reading Time: 1 min read

COVERED CALLS & PROTECTIVE PUTS #

- COVERED CALLS: Sell a call option on a stock owned by the option writer.

Use: To generate cash on a stock that is not expected to increase above the exercise price.

- PROTECTIVE PUTS: Constructed by holding a long position in the underlying security and buying a put option.

Use: limit the downside risk at the cost of the put premium

SPREAD STRATEGIES #

- BULL & BEAR SPREADS:

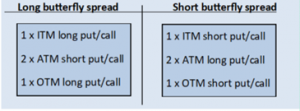

- BUTTERFLY SPREAD:

- CALENDER SPREAD: Sell short dated option & buy long dated option with same strike price.

COMBINATION STRATEGIES #

#

#

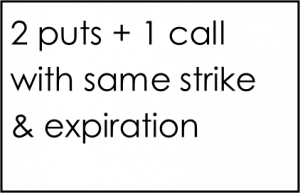

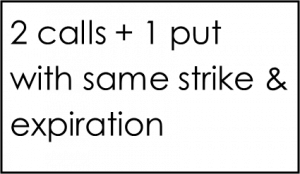

- STRIPS & STRAPS

- COLLAR: Combination of protective put & covered call.

INTEREST RATE CAPS & FLOORS #

- INTEREST RATE CAP: One party agrees to pay the other at regular interval, when the benchmark interest rate ( ex– LIBOR) exceeds the cap rate (strike rate) specified in the contract.

- INTEREST RATE FLOOR: One party agrees to pay the other at regular interval, when the benchmark interest rate ( ex– LIBOR) falls below the floor rate (strike rate) specified in the contract.

- INTEREST RATE COLLAR: Simultaneous position in a floor and a cap on the same benchmark rate over the same period with the same settlement date.

Purchase cap & sell a floor

Purchase a floor & sell a cap

- Zero cost collar: Premium paid for buying the cap is equal to premium received from selling the floor.

Updated on August 31, 2022