- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

C10 INTEREST RATE FUTURES

DAY COUNT CONVENTIONS #

Day count conventions play a role when computing the interest that accrues on a fixed income security. When a bond is purchased, the buyer must pay any accrued interest earned through the settlement date.

accrued interest = coupon X (# of days from last coupon to the settlement date/# of days in coupon period)

There are three commonly used day count conventions.

- Treasury bonds use actual/actual.

- corporate and municipal bonds use 30/360.

- money market instruments (T bills) use actual/360.

QUOTATIONS FOR T-BONDS #

T-bond prices are quoted relative to a $100 par amount in dollars and 32nds. So a 95—05 is 95 5/32, or 95.15625.

CLEAN & DIRTY PRICES

The cash price (a.k.a. invoice price or dirty price) is the price that the seller of the bond must be paid to give up ownership. It includes the present value of the bond (a.k.a. quoted price or clean price) plus the accrued interest.

Dirty price = quoted price + accrued interest

Clean price = dirty price—accrued interest

QUOTATIONS FOR T-BILLS #

T-bills and other money-market instruments use a discount rate basis and an actual/360 day count. A T-bill with a $100 face value with n days to maturity and a cash price of Tis quoted as:

T-bill discount rate =(360/n) x (100 — Y)

TREASURY BOND FUTURES #

In a T-bond futures contract, any government bond with more than 13 years to maturity on the first of the delivery month (and not callable within 15 years) is deliverable on the contract. Since the deliverable bonds have very different market values, the Chicago Board of Trade (CBOT) has created conversion factors. The conversion factor defines the price received by the short position of the contract.

Specifically, the cash received by the short position is computed as follows:

cash received = (QFP x CF) + AI

where: QFP = quoted futures price (most recent settlement price) CF = conversion factor for the bond delivered AI = accrued interest since the last coupon date on the bond delivered.

CHEAPEST – TO-DELIVER BOND

The procedure to determine which bond is the cheapest-to-deliver (CTD) is as follows:

cash received by the short = (QFP x CF) + AI

cost to purchase bond = (quoted bond price + AI)

The CTD bond minimizes the following: quoted bond price – (QFP x CF). This expression calculates the cost of delivering the bond.

TREASURY BOND FUTURE PRICE #

The futures price is calculated in the following fashion:

F0 = (S0 – I)erT

where: I = present value of cash flow

We can use this equation to calculate the theoretical futures price when accounting for the CTD bond’s accrued interest and its conversion factor.

EURODOLLAR FUTURES #

The 3-month eurodollar fixtures contract trades on the Chicago Mercantile Exchange (CME) and is the most popular interest rate futures in the United States. This contract settles in cash and the minimum price change is one “tick,” which is a price change of one basis point, or $23 per $ 1 million contract.

CONVEXITY ADJUSTMENT

The daily marking to market aspect of the futures contract can result in differences between actual forward rates and those implied by futures contracts. This difference is reduced by using the convexity adjustment. In general, long-dated eurodollar futures contracts result in implied forward rates larger than actual forward rates.

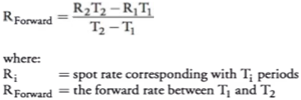

Forward rates implied by convexity-adjusted eurodollar futures can be used to produce a LIBOR spot curve (also called a LIBOR zero curve).

DURATION BASED HEDGING #

The objective of a duration-based hedge is to create a combined position that does not change in value when yields change by a small amount. In other words, a position that has a duration of zero needs to be produced. The duration-based hedge ratio can be expressed as follows:

N= -(P x DP)/ (F x DF)

Where : N= number of contracts to hedge

DP = Duration of the portfolio at the hedging horizon

DF = Duration of the futures contract

P = Portfolio Value

F = Futures Value

LIMITATIONS OF DURATION #

The price/yield relationship of a bond is convex, meaning it is nonlinear in shape. Duration measures are linear approximations of this relationship. Therefore, as the change in yield increases, the duration measures become progressively less accurate. Moreover, duration implies that all yields are perfectly correlated. Both of these assumptions place limitations on the use of duration as a single risk measurement tool. When changes in interest rates are both large and nonparallel (i.e., not perfectly correlated), duration-based hedge strategies will perform poorly.

Updated on August 31, 2022