- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C08 PROPERTIES INTEREST RATES

Reading Time: 4 min read

TYPES OF RATES #

- Treasury Rates: Treasury rates are the rates that correspond to government borrowing in its own currency. They are considered risk-free rates.

- LIBOR: The London Interbank Offered Rate (LIBOR) is the rate at which large international banks fund their activities. Some credit risk exists with LIBOR.

- Repo Rates: The “repo” or repurchase agreement rate is the implied rate on a repurchase agreement.

COMPOUNDING #

If we have an initial investment of A that earns an annual rate R, compounded m times a year for n years, then it has a future value of:

![]()

If our same investment is continuously compounded over that period, it has a future value of:

![]()

SPOT (ZERO) RATES AND BOND PRICING #

SPOT RATES

Spot rates are the rates that correspond to zero-coupon bond yields. They are the appropriate discount rates for a single cash flow at a particular future time or maturity.

BOND PRICING

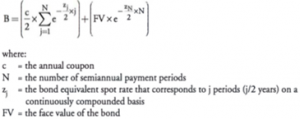

A coupon bond is a series of zero- coupon bonds, and its value, assuming continuous compounding & semi-annual coupons, is:

BOND YIELD

The yield of a bond is the single discount rate that equates the present value of a bond to its market price.

The bond’s par yield is the rate which makes the price of a bond equal to its par value. When the bond is trading at par, the coupon will be equal to the bond’s yield.

BOOTSTRAPPING SPOT RATES The theoretical spot curve is derived by interpreting each Treasury bond (T-bond) as a package of zero-coupon bonds. Using the prices for each bond, the spot curve is computed using the bootstrapping methodology.

FORWARD RATES #

Forward rates are interest rates implied by the spot curve for a specified future period. Forward rates are computed from spot rates. When the spot curve is upward-sloping, the corresponding forward rate curve is upward-sloping and above the spot curve. When the spot curve is downward-sloping, the corresponding forward rate curve is downward-sloping and below the spot curve.

FORWARD RATE AGREEMENTS #

A forward rate agreement (FRA) is a forward contract obligating two parties to agree that a certain interest rate will apply to a principal amount during a specified future time. The T2 cash flow of an FRA that promises the receipt or payment of RK is:

cash flow (if receiving RK) = L x (RK -R )x (T2 — T1 )

cash flow (if paying R K) = L x (R — RK) x (T2 — T1)

where: L = principal

Rk = annualized rate on L expressed with compounding period

T1 – T2

R = annualized actual rate, expressed with compounding period T1 — T2

Ti = time i, expressed in years

The value of an FRA if were receiving or paying is:

value (if receiving RK) = Lx (Rk – Rforward) x (T2 – T1)x e-R2xT2

value (if paying RK) = L X (RForward – RK) x (T2 – T1) x e-R2xT2

where: RForward = forward rate between T1 and T2

Note that R2 is expressed as a continuously compounded rate.

DURATION #

The duration of a bond is the average time until the cash flows on the bond are received. The formula for duration using continuously compounded discounting of the cash flows is:![]()

Where: ti = the time (in yrs) until cash flow ci is to be received

y = the continuously compounded yield (discount rate) based on a bond price of B.

MODIFIED DURATION

Modified duration is used when the yield given is something other than a continuously compounded rate.

Modified duration = duration/ (1+y/m)

Where m is the number of compounding periods per year

CONVEXITY #

Convexity shows that the difference between actual and estimated prices widens as the yield swings grow. That is, the widening error in the estimated price is due to the curvature of the actual price path. This is known as the degree of convexity.

In order to obtain an estimate of the percentage change in price due to convexity, the following calculation will need to be made: Convexity effect = 1/2 x convexity x Δy2

Combining duration and convexity creates a more accurate estimate of the percentage change in the price of a bond:

percentage bond price change = duration effect + convexity effect

The expectations theory suggests that forward rates correspond to expected future spot rates. The market segmentation theory states that bonds are segmented into different maturity sectors and that supply and demand dictate rates in the segmented maturity sectors. The liquidity preference theory suggests that longer-term rates incorporate a liquidity premium.

Updated on August 31, 2022