- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C08 PRICES, DISCOUNT FACTORS, & ARBITRAGE

Reading Time: 3 min read

FUNDAMENTALS OF BOND VALUATION #

There are three steps in the bond valuation process:

Step 1: Estimate the cash flows over the life of the security. For a bond, there are two types of cash flows: (1) the coupon payments and (2) the return of principal.

Step 2: Determine the appropriate discount rate based on the risk of (uncertainty about) the receipt of the estimated cash flows.

Step 3: Calculate the present value of the estimated cash flows by multiplying the bond’s expected cash flows by the appropriate discount factors.

PRICE YIELD CURVE

Bond values and bond yields are inversely related. An increase in the discount rate will decrease the present value of a bond’s expected cash flows; a decrease in the discount rate will increase the present value of a bond’s expected cash flows.

DISCOUNT FACTORS #

Discount factors are used to determine present values. The discount function is expressed as d(t), where t denotes time in years.

DETERMINING VALUE USING DISCOUNT FUNCTIONS

Since investors do not care about the origin of a cash flow, all else equal, a cash flow from one bond is just as good as a cash flow from another bond. This phenomenon is commonly referred to as the law of one price. If investors are able to exploit a mispricing because of the law of one price, it is referred to as an arbitrage opportunity.

CONSTRUCTING A REPLICATING PORTFOLIO #

To create a replicating portfolio using multiple fixed-income securities, we must determine the face amounts of each fixed-income security to purchase, which match the cash flows from the bond we are trying to replicate.

TREASURY COUPON BONDS & TREASURY STRIPS #

Zero-coupon bonds issued by the Treasury are called STRIPS (separate trading of registered interest and principal securities). STRIPS are created by request when a coupon bond is presented to the Treasury. The bond is “stripped” into two components: principal and coupon (P-STRIPS and C-STRIPS, respectively).

ADVANTAGES: •Mitigates reinvestment risk.• good for asset liability management or hedging purposes.

DISADVANTAGES: •They can be illiquid. • Shorter-term C-STRIPS tend to trade rich. • Longer-term C-STRIPS tend to trade cheap. • P-STRIPS typically trade at fair value. • Large institutions can potentially profit from STRIP mispricing relative to the underlying bonds.

COMPUTING PRICE BETWEEN COUPON DATES #

ACCRUED INTEREST

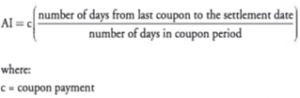

When a bond is purchased, the buyer must pay the owner for any interest earned up through the settlement date. This is called accrued interest (AI) and is computed as:

DAY COUNT CONVENTION

The day count used will depend on the type of security.

For example, U.S. government bonds pay coupons semiannually and have an actual/actual day count. U.S. corporate and municipal bonds pay semi annual interest with a 30/360 day count. U.S. government agencies pay annually, semi annually, and quarterly coupons with a 30/360 day count.

CLEAN & DIRTY BOND PRICING

The dirty price is the price that the seller of the bond must be paid to give up ownership. It includes the present value of the bond plus the accrued interest. The clean price is the dirty price less accrued interest:

Clean price = dirty price—accrued interest

Updated on February 18, 2022