- +91 9096131868

- falconedufin@gmail.com

- All Day: 10:30 AM - 9:30 PM IST

How can we help you?

C11 APPLYING DURATION AND CONVEXITY

Reading Time: 4 min read

INTEREST RATE FACTORS #

Measures of interest rate sensitivity allow investors to evaluate bond price changes as a result of interest rate changes. Being able to properly measure price sensitivity can be useful in the following situations:

- Hedgers must understand how the bond being hedged as well as the hedging instrument used will respond to interest rate changes.

- Investors need to determine the optimal investment to make in the event that expected changes in rates do in fact occur.

- Portfolio managers would like to know the portfolio level of volatility for expected changes in rates.

- Asset/liability managers need to match the interest rate sensitivity of their assets with the interest rate sensitivity of their liabilities.

DOLLAR VALUE OF A BASIS POINT #

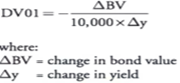

The DV01 is the “dollar value of an 01,” meaning the change in a fixed income security’s value for every one basis point change in interest rates. DV01 is the absolute change in bond price for every basis point change in yield.DV01 is computed using the following formula:

The DV01 formula is preceded by a negative sign, so when rates decline and prices increase, DV01 will be positive.

DV01 APPLICATION TO HEDGING #

Sensitivity measures like DV01 are commonly used to compute hedge ratios. Hedge ratios provide the relative sensitivity between the position to be hedged and the instrument used to hedge the position. The goal of a hedge is to produce a combined position that will not change in value for a small change in yield. This is expressed as:

dollar price change of position = dollar price change of hedging instrument.

DV01 VS. DURATION #

- While DV01 measures the change in dollar value of a security for every basis point change in rates, duration measures the percentage change in a security’s value for a unit change in rates.

- Duration is more convenient than DV01 in an investing context, in that a high duration number can easily alert an investor of a large percentage change in value.

- when analyzing trading or hedging situations, percentage changes are not that useful because dollar amounts of the two sides of the transaction are different. In this case, DV01 would be more useful.

DURATION #

Duration is the most widely used measure of bond price volatility. A bond’s price volatility is a function of its coupon, maturity, and initial yield. Duration captures the impact of all three of these variables in a single measure.

Macaulay duration is an estimate of a bond’s interest rate sensitivity based on the time, in years, until promised cash flows will arrive.

Modified duration is derived from Macaulay duration and offers a slight improvement over Macaulay duration in that it takes the current YTM into account:

![]()

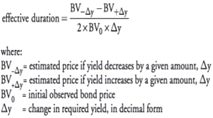

Modified duration is not an appropriate measure of interest rate sensitivity for bonds with embedded options. For callable & putable bonds, we instead use the formula for effective duration.

CONVEXITY #

Convexity is a measure of the curvature in the relationship between bond yield and price.

![]()

PRICE CHANGE USING BOTH DURATION & CONVEXITY

The amount of convexity embedded in a bond can be accounted for by adding the convexity effect to duration effect as:

PORTFOLIO DURATION AND CONVEXITY #

The duration of a portfolio of individual securities equals the weighted sum of the individual durations. Each security’s weight is its value taken as a percentage of the overall portfolio value.

NEGATIVE CONVEXITY #

When the price begins to rise at a decreasing rate in response to further decreases in yield, the price-yield curve “bends over” to the left and exhibits negative convexity.

Convexity is an exposure to volatility, so as long as interest rates move, bond returns will increase when convexity is positive. Conversely, when convexity is negative, movement in either direction reduces returns. In other words, if an investor wishes to be “long volatility,” a security exhibiting positive convexity should be chosen, and if short volatility is desired, a security exhibiting negative convexity should be chosen.

CONSTRUCTING A BARBELL PORTFOLIO #

A barbell strategy is typically used when an investment manager uses bonds with short and long maturities, thus forgoing any intermediate-term bonds.

A bullet strategy is used when an investment manager buy bonds concentrated in the intermediate maturity range.

The advantages and disadvantages of a barbell versus a bullet portfolio are dependent on the investment manager’s view on interest rates. If the manager believes that rates will be especially volatile, the barbell portfolio would be preferred over the bullet portfolio.

Updated on February 16, 2022